Decoding the 1099-MISC Form: An In-Depth Guide for Employers Engaging Independent Contractors

The 1099-MISC tax form is pretty common, but who exactly needs one? Well, it’s usually given to independent...

Demystifying Form 1099: An In-Depth Guide for Employers

A 1099 form is a document used in the U.S. to report various types of income. Businesses issue...

A Gentle Decline in Loan Approvals for Small Businesses at Select Banks

Small businesses are currently struggling to secure the capital they need, despite a slight increase in loan approval...

Exploring the 2020 IRS Mileage Rate: Essential Insights

The IRS has shared its new standard mileage rates for 2020. The most noticeable change is the reduced...

Enhance Your Mobile Email Engagement with These 5 Effective Approaches

Imagine this: You wake up, grab your phone, and see a flood of 100 emails. What’s your first...

2022 Mileage Reimbursement Rate Revealed: IRS Shares Update

The IRS has recently updated the standard mileage rates for 2022, and there are a few changes you...

The 2023 Mileage Reimbursement Rate: A New Update from the IRS

The IRS has announced an increase in the standard mileage rate for 2023, which is now 65.5 cents...

Introducing the 2024 Mileage Reimbursement Increase: IRS Establishes New Rate at 67 Cents per Mile

The IRS has updated the standard mileage rates for 2024, which are used to calculate the deductible costs...

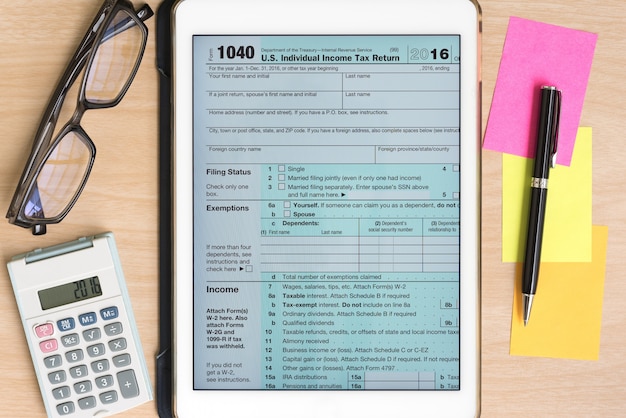

Exploring 10 Often-Missed Tax Deductions for Travel Expenses in the 2023 Tax Year

Image: Envato Elements

Charting Your 2024 Path: An In-Depth Exploration of Tax Payment Estimates and Deadlines

Let’s break down the concept of estimated tax payments, shall we? It’s not as complicated as it sounds....